The Coming Recession

A recession is a significant decline in economic activity lasting more than a few months. It is visible in real GDP, real income employment industrial production, and wholesale-retail sales. Also, a theory based on the idea that when people lose their jobs they stop spending money which can lead to a downward spiral in the economy. There are a number of key indicators that can be used to measure inflation. The Consumer Price Index (CPI) is perhaps the most well-known measure which looks at the prices of a representative basket of goods and services. Other important indicators include the Producer Price Index (PPI) which measures the prices charged by manufacturers and the GDP deflator which is a measure of inflation in the wider economy. There are a number of factors that can cause inflation to increase. One is simply an increase in demand for goods and services relative to supply. This can be caused by population growth or strong economic growth. Another factor is an increase in the cost of raw materials or energy which can lead to higher prices for finished goods. Inflation can also be caused by government policies such as printing more money or increasing government spending. High inflation, Fx scarcity, high food/ energy prices, etc – all the signs are already there. And these events will have a wider cascade effect – low productivity output, debt defaults, social dislocations, and many more.

How Should African Governments React To This Recession?

This is what I found out; As a result of COVID-19, declining remittances, tourism, oil and commodities sale volumes are estimated by McKinsey that Africa’s economy may lose between the US $90 billion and the US $200 billion of GDP growth with individual countries seeing between a 3-6% drop. The Covid impact has been exacerbated by the Russian war of aggression against Ukraine, causing still more supply chain disruptions. This negativity manifests in higher grain and pump prices and skyrocketing food prices. Some governments have reacted by curbing or limiting access to foreign exchange (NG, Malawi, GH, KN, etc), levying higher taxes on individuals and enterprises, and imposing new taxes (such as Cameroun and Ghana’s e-Levy which adds 1.5% to the cost of electronic transactions) All these measures conceived to mitigate a general decline in revenue accruals (J.P Morgan recently reported that the NNPC did not make any payments to the Fed Government of Nigeria account from Jan to March 2022 despite the Russia war oil windfall)

It is believed that the approach should be proactive and deliberate rather than reactive and these challenges should spur African governments across the board towards lowering “barriers to business and entrepreneurship.” by offering incentives to spur rapid growth in the Agric sector to augment the food supply and achieve price stability. Similarly, the digital industry ( mobile banking and payments) promotes financial inclusion and “brings more people into the cashless economy.” The coming period of economic difficulties presents a perfect opportunity to grow the Technology sector. They should commit to digitizing their entire operations and as a matter of national competitiveness and security, growing at least 2 local unicorns over the next ten years. Depending on the country, between 2-5% of GDP should be invested in Technology (or between 5-10% of their total public expenditure). Dr. Aloy Chife

Kenya’s 35% stake in Safaricom etc, and Saudi’s investment in Uber ($3.5bn) and Twitter, etc, are broad statements about securing the future. In general, the times call for them to become very aggressive in building competitive firms. Regulators should be refocused as drivers of change and transformation (not gatekeepers). Henceforth African Regulators need to be measured by the success of the industry they regulate. The state should set performance targets- every key industry regulator must build a minimum of 3 successful companies in the industry every year. Regulators should also provide support services in the industry they regulate providing new knowledge and resources for enterprise growth. The Monetary Authority of Singapore (MAS) actively promotes its global interests. Thunes is presently building a SWIFT alternative. In summary, African governments need to see the downwind as an opportunity to use digital technology as a significant, offensive, and commercial tool to repurpose their economies and become a more potent competitor in the international marketplace. We have seen many relapses in the system, especially after the Covid-19 lockdown in government schools here, One should have expected that government will step up with technology on e-learning for its pupils for a seamless flow of the academic year. Rather they resulted in taking turns to go to school and attending only 2/3 times a week. The world has changed and every African country must brace up.

Recession Depression

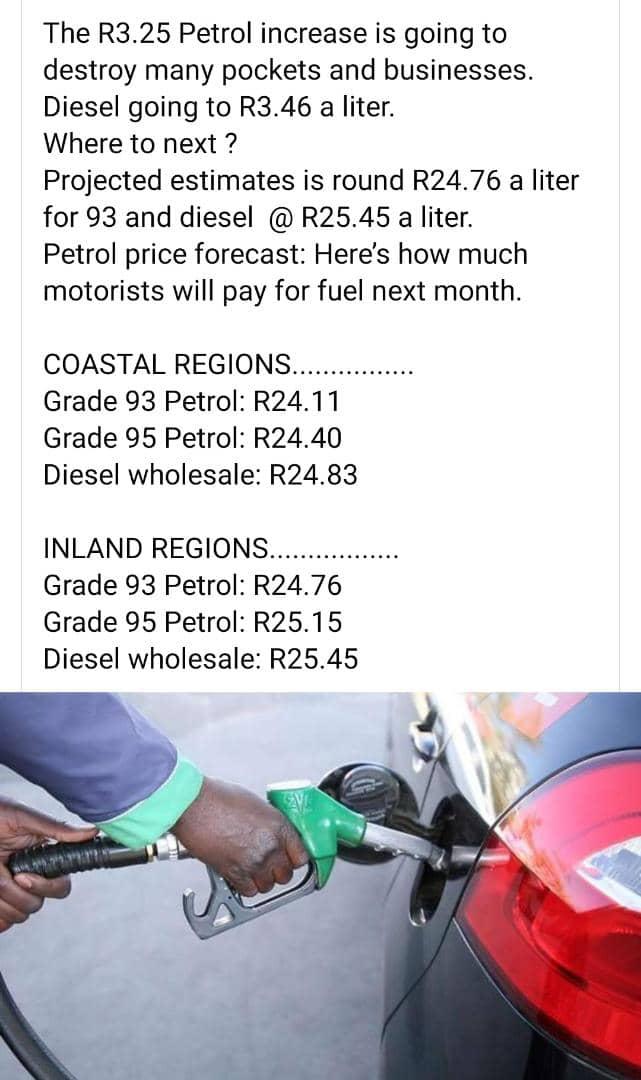

As I received this fuel analysis below via my WhatsApp number, though our PMS is @N$18.32 a liter as of today I know it’s a matter of time. I began to reflect deeply knowing that economical and financial hard time is upon us. There’s a price hike on every commodity and service, inflation, and food shortages. Masses are finding an easy and affordable way to survive by looking out only for the basics YET corruption is on the rise, and no avenues or infrastructures are created for revenues. The poor are sinking deeper! Do the lawmakers have their country’s interest at heart, no thought on how the economy or society is impacted? Personally, I believe the government cutting down its running cost will go a long way too, the costs of running the government puts a burden on all its citizens. Capital expenditures! We are slowly drawing to ‘ all man to himself, God for us all ‘ It’s a recession when your neighbor loses his job; it’s a depression when you lose your own.

An Entrepreneur , B.A Foreign Languages ,PGD Health and Social care Management ,American Caregiver Association (Member) ACA Certified, Leadership and Management.